vermont state tax rate

Employers pay unemployment taxes at a New Employer rate until such time as they earn a rate based on their experience with unemployment. IN-111 Vermont Income Tax Return.

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Community

Car Truck Trailer and Motorcycle Titles.

. State corporate income tax rates range from 0 999. Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects individual income taxes similarly for Single versus Married filing statuses for example. Update on 2022 Employer Rate Notices.

But not all states levy a corporation tax rate. Please reference the Alabama tax forms and instructions booklet published by the Alabama Department of Revenue to determine if you owe state income tax or are due a state income tax refund. FY2023 Property Tax Rates.

This includes interest taxed at the federal level but exempted for Vermont income tax purposes and interest not taxed at the federal level. Alabama income tax forms are generally published at the end of. Depending on local municipalities the total tax rate can be as high as 9.

The Georgia GA state sales tax rate is currently 4. Overall Vermont was Solid Democratic having voted for Barack Obama D. What is the SUI Tax Rate.

South Carolina Tax Brackets 2022 - 2023. Understand and comply with their state tax obligations. The following states do not have a state corporate tax rate.

State government websites often end in gov or mil. IN-111 Vermont Income Tax Return. Where even though I-91 runs up the Vermont side of the Connecticut River many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes.

Any entity that conducts business within Georgia may be required to register for one or more tax specific identification numbers permits andor licenses. Most states set a corporate tax rate in addition to the federal rate. SUI tax rates are part of the payroll taxes you are responsible for paying as a small business ownerSUI which stands for State Unemployment Insurance is an employer-funded tax that offers short-term benefits to employees who lost their jobs through a layoff or a firing that is not misconduct related.

Use this section to elect a withholding rate not listed on page 1. This is the first of six incremental reductions that will ultimately reduce the rate to 399 percent by tax year 2027. Beginning July 1 2004 the new employer rate for most employers is one percent 1.

I have read and understand the applicable State Income Tax Withholding Rules on this form and agree to abide by those rules and conditions. Tax Rate Schedules and Tables. Updated Weekly Benefit Amount Notices to Claimants.

PA-1 Special Power of Attorney. Certificate of Title New - 3500 Certificate of Title Replacement - 3500 Certificate of Title Corrected - 3500 Lien each - 1100 Title Search - 2200 ATV Motorboat and Snowmobile Titles. W-4VT Employees Withholding Allowance Certificate.

W-4VT Employees Withholding Allowance Certificate. Line f HOUSEHOLD INCOME - Interest on US state or municipal obligations Enter the income reported on federal Form 1040 and all interest income from federal state or municipal government bonds. For individuals employers and others looking for information about unemployment insurance resources in Vermont please review the links below or contact the UI Division for more information.

Overall the average sales tax rate in Vermont is 624. 2022 Alabama State Tax Rate Schedule published by the Alabama Department of Revenue. We can also see the progressive nature of South Carolina state income tax rates from the lowest SC tax rate.

Vermont has a number of sales tax exemptions that should limit the amount of sales taxes paid by most seniors. Furthermore economic nexus may be triggered. The state tax is payable on the first 15500 in wages paid to each employee during a calendar year.

Some cities including Burlington and Dover collect an additional sales tax of 1. 2021 the states flat income tax rate was reduced to 499 percent on January 1 2022. California has the highest state-level sales tax rate at 725 percent.

Before sharing sensitive information make sure youre on a state government site. The tax rate in most areas is 6. Following the 2020 presidential election 991 of Vermonters lived in one of the states 13 Solid Democratic counties which voted for the Democratic presidential candidate in every election from 2012 to 2020 and 09 lived Essex County the states one Trending Republican county.

File or Pay Online. PA-1 Special Power of Attorney. I file a tax return in Name of state Check and complete one box below Withhold Withhold Do not withhold.

Vermont School District Codes. Compare 2022 sales taxes including 2022 state and local sales tax rates.

Sanders Is Right Philadelphia S Proposed Soda Tax Is Regressive Though Small Proposal Tax Sanders

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Largest Lake In Every Us State Lake Map Map Geo

The Happiest Cities States Countries All In One Map Infographic Elephant Journal No Wonder My So Happy City Happiest Places To Live States In America

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

Vermont Named 1 Least Tax Friendly State For Retirees Vermont Business Magazine Retirement Retirement Locations Retirement Advice

Usa State Taxes 2017 950 5b Usa Veterans Volunteer Services Veteran Owned Business

States With The Highest And Lowest Property Taxes Property Tax Tax States

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Indigenous American Population As A Percentage By County 950x765 Amazing Maps Map Native American Population

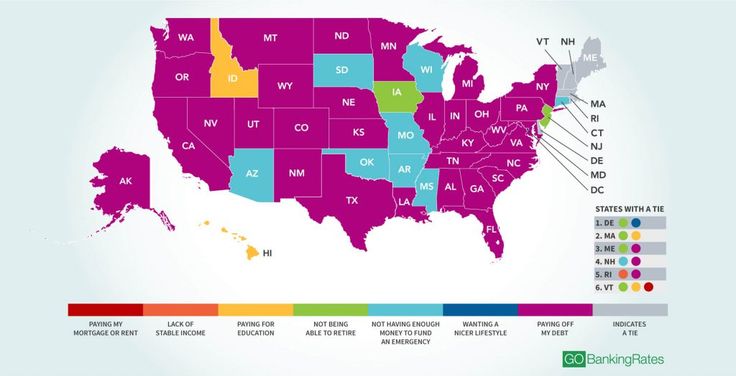

The No 1 Cause Of Financial Stress In Every State

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

States That Tax Six Figure Incomes At A Higher Rate Accidental Fire

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Insurance

Mean Elevation Of Each State In The U S Oc 2300x1500 Illustrated Map Map Usa Map

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Location Matters Effective Tax Rates On Corporate Headquarters By State Freedom Day Freedom Tax Day

Percent Of Electricity Produced From All Renewable Sources In The United States 2016 Oc Ponicrat Posted By Www Eurekaking Co Map Renewable Sources Renew